VIEW BLOG CATEGORIES

Search the blog

About Sandra

SML is an online destination that serves as an eclectic resource for inspiration and covers everything from fashion to home décor, travel, life advice recipes and wellness.

Get interior design Help

Shop the PResets

Shop Cloak + Linen

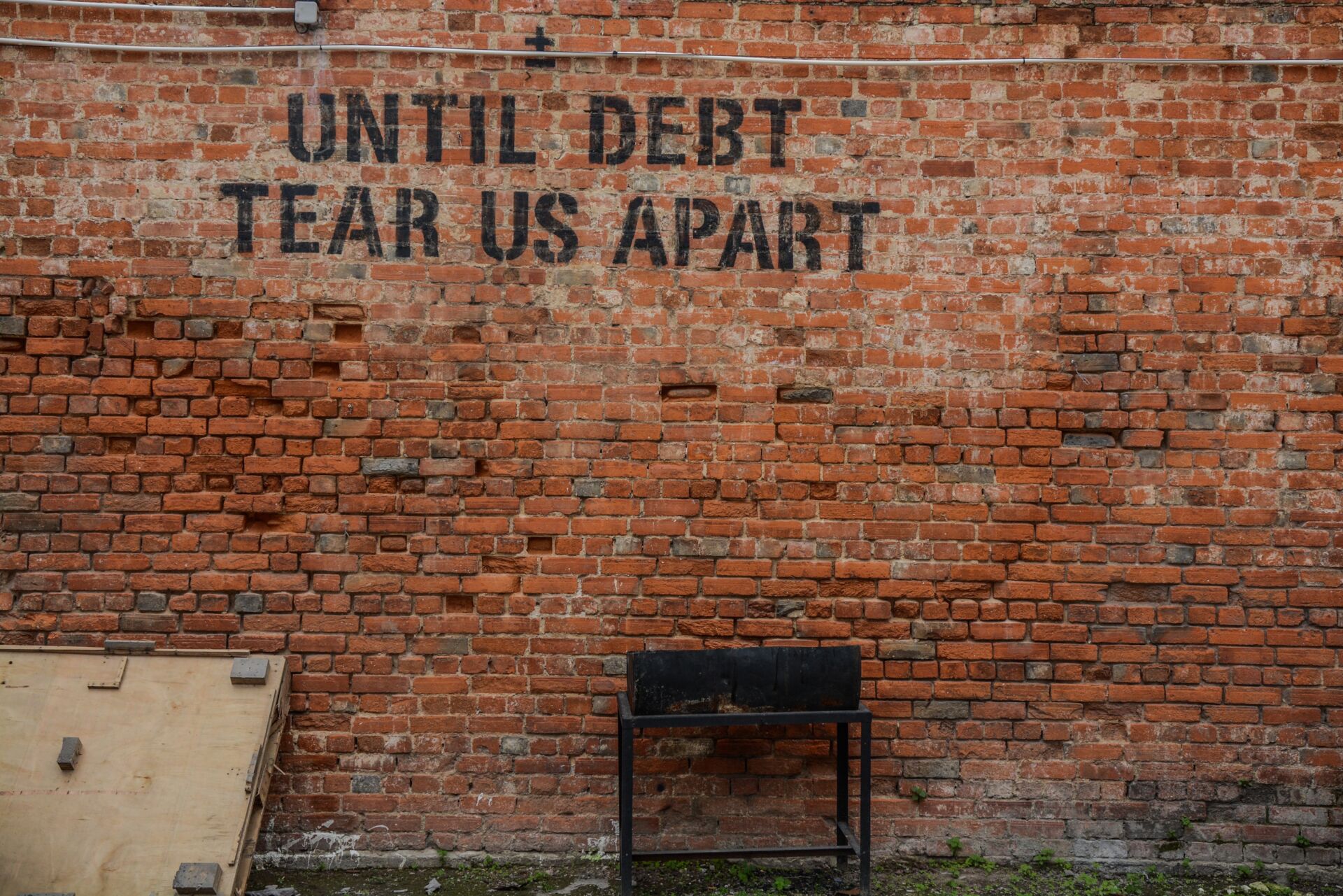

How many of us have debt? How many of us struggle to pay it off, yet continue to add to it? I came into the new year ready to change that. First of all, please know you’re not alone. Debt is considered anything owed to someone else, therefore, that means most of us Americans are in some form of debt. In today’s post, I’m sharing some easy, yet key strategies I’m using to help me lower/get ride of my debt in 2020.

CREATING A BUDGET

A lot of people make the mistake of throwing their money into what they have debts in and trying to figure out the rest. Figuring out your monthly costs, your monthly bills, what you are paying on a regular basis, etc.

It is easiest to start with what you make per month. Narrow down where all you’re money is going and what money you have “left over” at the end of each month. If you’re making $4000 a month, and your FIXED bills (things you cannot change), I.e. rent, cable, electricity, phone, etc. cost you $2,000 a month. We are now at $2,000 left over.

Now let’s factor in necessities, i.e. how you get around, wheather that be your own car, public transportation, etc. for this scenario we will say that costs you $200 a month. Now food, let’s add $300 a month for that. We now have $1,500 to spend on anything.

SAVING vs. SPENDING

I would suggest saving some of that money, building a savings and having a safety net for whatever life may unexpectedly throw at you is important. (Dave Ramsey suggests at least $1,000 as a basic safety net) Regardless, you have well enough money to put towards your debt.

Everyone’s income, budget and monies are going to be different, your plan is going to be different, but start now while you can. It’s the beginning of the year. There is no easier time to get everything together and in order than now. Paying the minimum payment on each debt is very important, but if you have more money each month to put into those debts, you will pay off your debt that much quicker. The smallest amount added to your minimum can make a difference.

ACKNOWLEDGING THAT SLOW AND STEADY WINS THE RACE

Start paying off your most expensive debt first, all debt matters, but your highest debt is most likely what is affecting you the most. Always paying more than the minim. What credit card companies don’t tell you is that if you’re using more than 30% of your overall available credit, it’s hurting your credit score. Pay attention to everything you’re bringing in and every dollar that is going out. I have a bad habit of not do that. Do not use credit cards to pay debts, it is just putting your debt in another place.

FINAL NOTES: When tracking your debt, do not be intimidated by your number. Calculating how much debt you are in is the start of fixing your debt problems and becoming debt free.

Leave a Reply Cancel reply

Wherever you live, however you live, Sandra’s goal is to help you create spaces you want to come home to. Spaces that feel welcoming, effortless and ready for living.

I really enjoyed reading this post. Thanks for the great savings tips.

You are so welcome Elizabeth